Banks around the world are increasingly enhancing the convenience of their clients. By providing online banking facilities, they’ve eliminated the need for people to visit banks in person to carry out financial transactions. Now, they’re employing AI-powered chatbots to automate conversations with them. This has lowered their costs, expanded reach, and met the growing demand of customers.

Bank of America, Barclays, HSBC, Ally Bank, Hang Seng Bank, and ATB Financial are the notable ones that are reaping the benefits of conversational automation. A study says that the banking chatbot will lower business costs of banks by over $8 billion per year by 2022 by ensuring a favorable digital customer experience.

Contents

What is a Banking Chatbot?

A banking chatbot is an AI-powered chatbot that integrates securely with banking systems and access customers’ data to facilitate a more personalized and enhanced customer interaction experience. Thus, these act as virtual customer interaction assistants that are available round the clock to support customer interactions.

Banks and other financial institutions can employ these to either fully or partially automate customer-facing financial transactions and banking services, restricting the need for human interventions. With these, customers can interact using their natural language to perform things like-

- Opening a bank account

- Making payments

- Verifying recent transactions

- Checking account balances

- Reporting fraud

- Transferring funds

- Reporting a lost or stolen card

- Applying for a personal loan

- Converting currency

- Provide credit report updates

- Downloading bank statements

- And more.

This blog will discuss some of these use cases in detail in its later part.

What are the Benefits of Banking Chatbot to the Banking Industry?

By leveraging the power of conversational chatbots, banks and other financial institutions can provide reliable and robust services to their customers.

1. Enhanced customer service:

Banks can significantly improve their customer service through conversational banking. This is owed to its certain attributes like speed, pleasant interactions, and access to information. Integrating an AI chatbot for banks can further enhance customer service by providing 24/7 support, personalized assistance, and efficient handling of routine inquiries, thereby improving overall customer satisfaction and operational efficiency.

2. Reduce phone waiting times and queues at bank branches:

By providing customers with a virtual assistant, banks can eradicate the need for them to wait on their phones or stand in a queue to be attended by a customer service rep.

3. Save time and money:

By assigning chatbots the responsibility to answer frequently-asked queries, banks can save the time of human staff. They can be allocated more complex customer service issues. This allows employees to focus on providing personalized solutions, such as tailoring services for high-net-worth clients. This can improve efficiency and productivity, which in turn will save banks a lot of money. Studies say that banks that adopt AI solutions will lower their operational costs by 22%, which would account for $1 trillion by 2030.

4. Personalize customer experience:

Most customers today expect personalized experiences from brands. Banking chatbots can facilitate this by utilizing customer data.

5. Increase customers and business opportunities:

Banks can employ a bank bot to educate prospects about the bank’s new service or product offerings. These can initiate a timely conversation with a website visitor to know whether he or she is interested in opening a term deposit or taking a loan. Thus, it can provide insightful information and generate new customers and business while remaining less intrusive.

6. Better risk mitigation:

Banking chatbots can simplify and manage the tedious process of evaluating crucial data related to the borrower’s most recent financial transactions, market trends, prospect’s loans, etc. for providing risk advice, generating credit reports, and more. Employing chatbots rather than human staff for these processes can mitigate the risks involved.

7. Maintain brand voice:

Banks can design their chatbot to stay consistent with their brand voice across their banking website and app. This can increase your reputation and reliability and foster brand affinity.

13 Powerful Use Cases for Chatbot in Banking

Banking chatbots can be used for the following purposes:

1. Send money:

Banks make use of chatbots to let their users quickly pay their bills, track money transfers, and initiate or cancel payments whenever needed. Chatbots further enable users to charge up their pre-paid cards or pay off credit card bills.

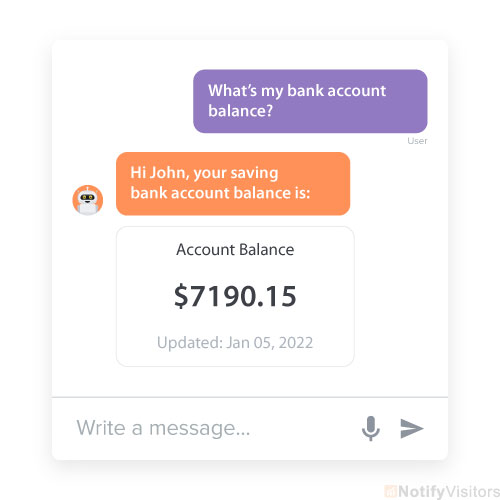

2. Check balances:

Banks can also let their customers check the balance money in their accounts by interacting with a chatbot. They can also alert users if balances are at the risk of falling below a specific amount. This way, customers can manage their accounts well without having to directly speak with their bank or even log into their e-account.

3. Avail services:

Chatbots make it easy and appealing for consumers to inquire about different kinds of services. Banks and financial institutions can let interested people know more about their loan products, credit card options, reward point redemptions, and more by employing banking chatbots. The bot can be then direct the qualified leads to the bank’s customer acquisition team to follow up.

4. Automate support:

Banking chatbots can be launched to be readily available to solve customers’ problems as they arise round the clock. Banks can automate answering their frequently asked questions using these chatbots. They can keep learning and improving themselves continually using advanced machine learning and algorithms. So, over time, they’ll be able to handle more complex commands.

5. Provide location-based services:

Sometimes, a banking-related query requires a response based on the customer’s location. For example, when a user wants to know the nearest ATM, a banking chatbot can suggest one based on the user’s GPS location or location entered by the user into its interface.

Additionally, for improved accuracy, the chatbot can utilize RTK corrections to refine location data, ensuring precise suggestions for nearby services.

6. Collect customer feedback:

Banks can also use conversational chatbots to gather customer feedback, which can aid them in making service improvements. Unlike other formal methods such as web surveys sent over traditional mails and email or having static, lengthy feedback forms incorporated into their websites, this interactive approach allows banks to collect feedback more casually.

7. Monitor transaction history:

Banks can also launch chatbots to let consumers get an overview of their transactions. Customers can ask for monthly or weekly reports of their incomes and expenses. They can even request the chatbot to alert them whenever there is a deposit, refund, or charge made to their account.

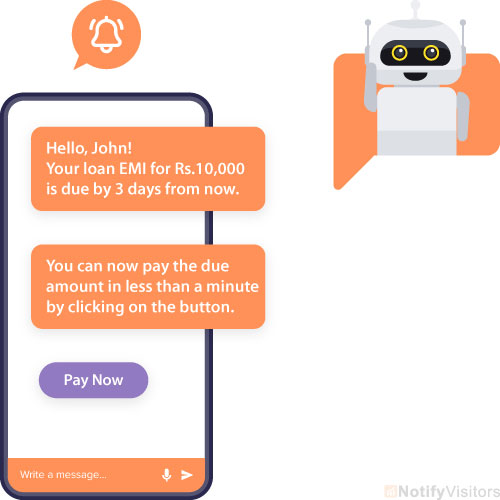

8. Send payment reminders:

Customers can also use banking chatbots to remind them to submit particular documents for availing of any financial services or pay their bills prior to deadlines. This can facilitate a better understanding of banking services among customers and increase customers’ usage of those.

9. Review and adjust accounts:

Banks can also employ chatbots to let users ask and know different aspects of their accounts apart from balances. For instance, recurring deposits, card bonus points, transfer limits, withdrawal limits, expense limits, and more. They can also be allowed to make modifications (such as updating their address) to their account info.

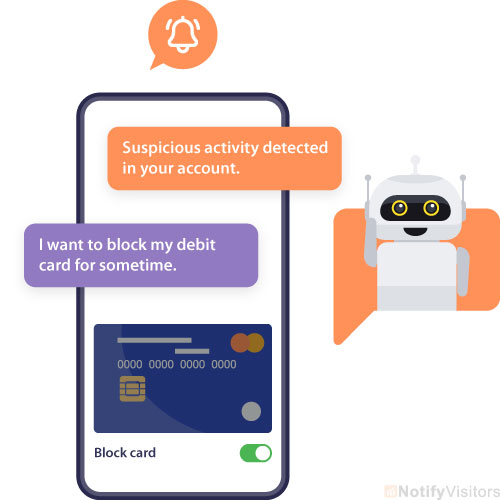

10. Suspicious activity alerts:

Banking chatbots can send push notifications to the concerned customers when suspicious activity is detected in their accounts. This can help customers to secure their accounts against further malicious practices (such as hacking) by taking certain measures like blocking their cards or learning how to void a check. These bots can also prioritize their issue and immediately connect them to live agents.

11. Personal banking assistance:

Chatbots can also be used to give valuable financial information such as charges for specific places or months, an annual review of recurring expenses, and their spending habits to consumers. This has to be backed by collecting and analyzing data.

This application for the banking chatbot can be especially beneficial for consumers who’re unable to access financial guidance owing to location or budget limitations. Insights like these are often highlighted in finance blog discussions, making them accessible to a wider audience.

12. Engage customers:

Chatbots deployed on the bank’s app or website could monitor and analyze customer behavior and interests, and initiate conversations with them. These can help them if they’re facing issues, ask them if they’re interested in learning more about banking products and gather feedback on how their experience can be improved.

13. Address urgent issues:

Sometimes certain issues faced by consumers may be simple but urgent. Like checking or converting bank statements, completing money transfers, resetting passwords, or locking or unlocking cards. Banks can use chatbots to resolve those quickly. This will eliminate added trouble especially when customers are already going through stressful processes.

An Important Thing to Consider

There are numerous potential uses cases for chatbots in banking. Already many of them are being used by several banks and financial institutions around the world. One important consideration in all these use cases is security. Data protection matters the most in banking than in any other industry. Data breaches in banks or other financial institutions where people have their money can lead to heavy devastations.

Therefore, banks need to fully protect their customers’ money and information. They also need to make customers aware of how exactly they’re protecting their accounts and ensuring their privacy. Additionally, they also need to provide their customers with security instructions like setting a passcode on mobile to ensure their mobile app’s security.

Wrapping up

Banking chatbots can integrate securely with banking systems and access customers’ data to provide reliable and robust services to their customers. Banks and other financial institutions can employ these to automate support, gather feedback, send alerts, engage customers, and address urgent issues, etc.; and enable customers to make payments, monitor transaction history, check balances, and avail services; and more.

These bots are therefore here to stay as an indispensable part of the banking sector. One vital aspect that they should take into account is the security of the customers’ money and information entrusted to them. Financial institutions like banks and credit unions can get in touch with NotifyVisitors to get your smart chatbot created.

Also Read:

Email

Email SMS

SMS Whatsapp

Whatsapp Web Push

Web Push App Push

App Push Popups

Popups Channel A/B Testing

Channel A/B Testing  Control groups Analysis

Control groups Analysis Frequency Capping

Frequency Capping Funnel Analysis

Funnel Analysis Cohort Analysis

Cohort Analysis RFM Analysis

RFM Analysis Signup Forms

Signup Forms Surveys

Surveys NPS

NPS Landing pages personalization

Landing pages personalization  Website A/B Testing

Website A/B Testing  PWA/TWA

PWA/TWA Heatmaps

Heatmaps Session Recording

Session Recording Wix

Wix Shopify

Shopify Magento

Magento Woocommerce

Woocommerce eCommerce D2C

eCommerce D2C  Mutual Funds

Mutual Funds Insurance

Insurance Lending

Lending  Recipes

Recipes  Product Updates

Product Updates App Marketplace

App Marketplace Academy

Academy